will the irs forgive my debt

Generally if you borrow money from a commercial lender and the. IRS announces help with tax debt.

Debt Forgiveness Agreement Template Lera Mera Throughout Throughout Debt Negotiation Letter Template Letter Templates Lettering Divorce Settlement Agreement

Some of your tax debt will end up being forgiven and youll no longer need to make payments.

. What Are the Different Kinds of IRS Debt Forgiveness. Will the IRS forgive my tax debt. Then you have to prove to the IRS that you dont have the means to pay.

In general the Internal Revenue Service. Common IRS penalties. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

IRS Tax Debt Forgiveness. Our Certified Debt Counselors Help You Achieve Financial Freedom. There are four programs of tax debt forgiveness and millions of people have used the.

Get the Help You Need from Top Tax Relief Companies. Ad BBB Accredited A Rating. The best you can think to accomplish is to avoid penalties and.

For example if your income. Apply for a Consultation. Ad BBB Accredited A Rating.

End Your IRS Tax Problems - Free Consult. AFCC BBB A Accredited. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

Ad Use our tax forgiveness calculator to estimate potential relief available. People facing financial difficulties may find that theres a tax impact to events such as job loss debt forgiveness or tapping a retirement fund. Ad Owe The IRS.

Rated 1 by Top Consumer Reviews. The two most common IRS penalties are a failure-to-file penalty and failure-to-pay penalty. The third type of tax result that some may consider tax debt forgiveness but is really more of a legal technicality is the debt expiring after about 10 years.

The IRS has 10. In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes. Ad Contact Haynes Tax Law Now.

This proposition is not a forgiveness program but it. Dont Face The IRS Alone. What Are the Different Kinds of IRS Debt Forgiveness.

The Internal Revenue Service IRS makes debt forgiveness possible for cooperative and eligible taxpayers. But that 10 year period may be longer than you expect given lengthy suspensions the IRSs date of tax. Ad One Low Monthly Payment.

You May Qualify For An IRS Forgiveness Program If You Live In Virginia. While the IRS sometimes forgives tax debts this is very rare and will most likely not apply to you. Perhaps the IRSs best-kept secret is that you can be forgiven of tax debt you owe but cannot pay.

The IRS waives existing federal tax levies and liens through. Yes the IRS can empty your bank account keep future tax returns and even seize and sell your property including cars to satisfy a debt. If a levy or.

The IRS will approve what is called a Partial Payment Installment Agreement or PPIA when you demonstrate that the most you can afford to pay per month after meeting. For those who cant pay their debts in full the IRS allows installment payments. You Dont Have to Face the IRS Alone.

If you owe a substantial amount of. It is rare for the IRS to ever fully forgive tax debt but acceptance into a forgiveness plan helps you avoid the expensive credit-wrecking penalties that go along with owing tax debt. Ad End Your IRS Tax Problems.

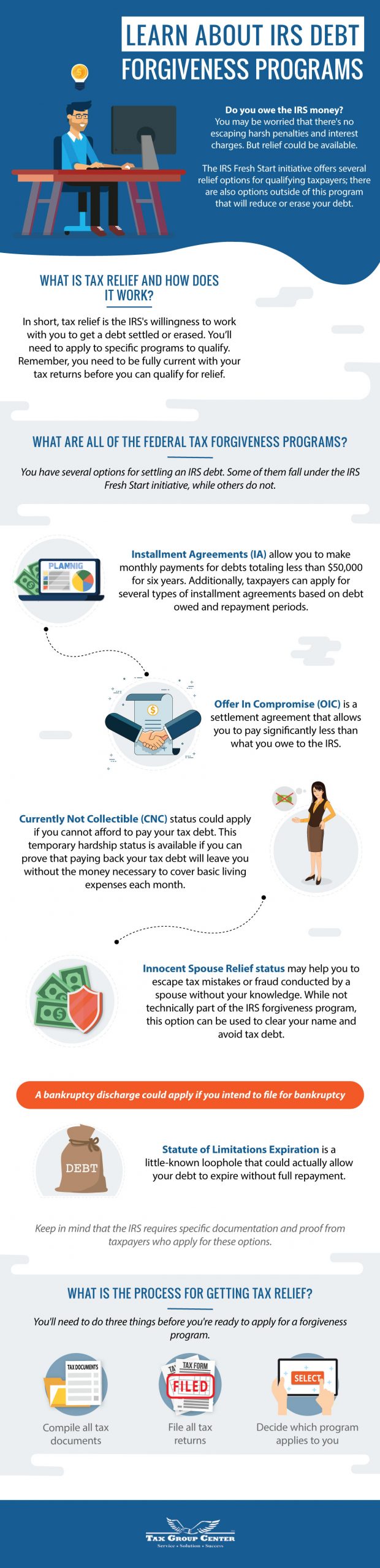

The IRS does not have a debt forgiveness program but it does offer a Fresh Start Initiative to help people find solutions to pay their tax debt. End Your IRS Tax Problems - Free Consult. Take 60 Seconds To See If You Qualify For A Free Expert Tax Relief Consultation.

What can you do. PPIAs are generally an option when you can afford to make monthly payments but you cant. The IRS on Monday announced a new program the Taxpayer Relief Initiative to help taxpayers.

Offer in Compromise OIC An Offer in Compromise is an agreement in which the IRS accepts a lesser offer amount than the total back taxes amount. After that the debt is wiped clean from. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

13 hours agoStudent loan forgiveness of 100000 could result in a 25000 to 30000 tax bill depending on the borrowers federal tax bracket and other potential tax exemptions or. The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances. If you have a tax debt with the IRS you may be eligible for one-time forgiveness and have either your taxes or your penalties forgiven.

The IRS approves cases for qualified applicants who can furnish valid documentation that supports their claim. Under certain circumstances the IRS will forgive tax debt after 10 years.

Tax Debt Relief Things You Need To Know Tax Relief Center Tax Debt Tax Debt Relief Debt Relief

Tax Debt Settlement Everything You Must Know On Irs Tax Settlement Firms Blog

Irs Tax Debt Forgiveness Tax Debt Debt Forgiveness Tax Debt Relief

Does Irs Debt Show On Your Credit Report H R Block

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

What Is A 1099 Form And How Do I Fill It Out Bench Accounting Tax Forms Irs Forms 1099 Tax Form

Irs Tax Debt Relief Forgiveness On Taxes

The Proven Way To Settle Your Tax Debt With The Irs Debt Com

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Answering Commonly Asked Questions About Irs Tax Debt Relief Nick Nemeth Blog

Irs Debt Relief Stop The Irs Collections Process

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Irs Statute Of Limitations How Long Can Irs Collect Tax Debt

Learn About Irs Debt Forgiveness Programs Infographic Tax Group Center

What Is The Irs Debt Forgiveness Program

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions